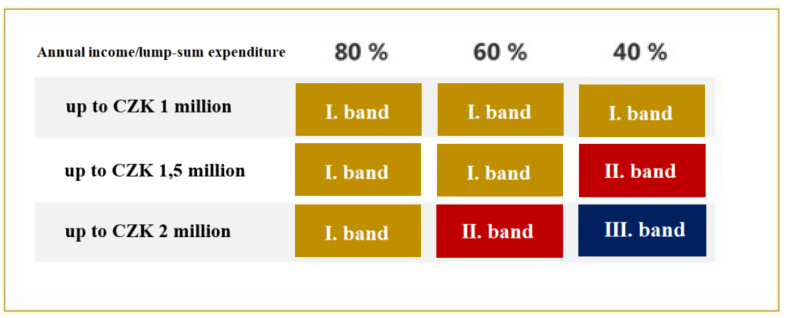

The principles for inclusion in the individual flat-rate tax bands remain the same (see article from last year Changes in flat-rate tax from 2023). However, due to the increase in the average wage and the increase in the assessment base of social security from 25% to 30% of the average wage, there is an increase in all bands.

What is the new amount of monthly lump-sum advances and lump-sum tax?

The amount of the taxpayer’s lump-sum advances in the 2024 advance period by flat rate band is as follows:

- Band I of the flat rate scheme: CZK 7 498

- Band II of the flat rate scheme: CZK 16 745

- Band III of the flat rate scheme: CZK 27 139

| Monthly prepayments | Total amount | Income tax | Pension insurance | Health insurance |

| I. band | CZK 7 498 | CZK 100 | CZK 4 430 | CZK 2 968 |

| II. band | CZK 16 745 | CZK 4 963 | CZK 8 191 | CZK 3 591 |

| III. band | CZK 27 139 | CZK 9 320 | CZK 12 527 | CZK 5 292 |

We remind you that entry into the flat-rate scheme is voluntary and it is possible to register until 10 January 2024. Those taxpayers who used the flat-rate tax in 2023 and for whom the current increase would mean a disadvantage may consider leaving the flat-rate scheme. This must also be notified to the tax office by 10 January 2024.