Understanding your tax obligations in the Czech Republic is essential, especially if you’re an expat, freelancer, or employee with multiple sources of income. According to Section 38g of the Czech Income Tax Act (ZDP), there are several situations in which filing a personal income tax return is mandatory.

1. General Obligation Based on Income

You must file a tax return if your total annual income subject to personal income tax exceeds CZK 50,000 — unless the income is:

- Exempt from tax, or

- Already taxed via withholding tax at a special rate (as per Section 36 ZDP).

Even if your income does not exceed CZK 50,000, you must still file a tax return if you report a tax loss.

2. Employees with a Single Employer

You are not required to file a tax return if:

- You only had income from dependent employment (§ 6 ZDP) from one employer or from several employers consecutively,

- You signed a tax declaration (§ 38k ZDP) with all of them for the relevant tax period,

- You had no other taxable income exceeding CZK 20,000 (excluding exempt income and income subject to final withholding tax).

3. Non-Residents Claiming Deductions

Tax non-residents must file a tax return if they claim:

- Personal tax reliefs (excluding the basic tax deduction),

- Tax advantages (such as child tax credit),

- Or deductions from the tax base.

4. Late-Paid Employment Income

You must also file a tax return if you received delayed employment income for past years that wasn’t considered taxable income in the year it was paid out by the employer.

5. Donations Made Abroad

If you are an employee claiming a deduction for a charitable donation made abroad, you must file a tax return, provided the donation meets the criteria under ZDP.

6. Optional Filing for Certain Non-Residents

Tax non-residents from the EU or EEA may voluntarily file a tax return and apply the special tax procedure under § 36(7) ZDP.

7. Other Cases Requiring a Tax Return

Filing a tax return is also mandatory if:

- It is required by the Tax Code (Act No. 280/2009 Coll.), for example, in case of the death of a taxpayer or due to insolvency proceedings,

- Your employer reported unpaid tax or an incorrectly paid tax bonus caused by your actions,

- You received income in relation to the return of state-supported retirement savings benefits.

8. Responsibility for Completing and Submitting the Return

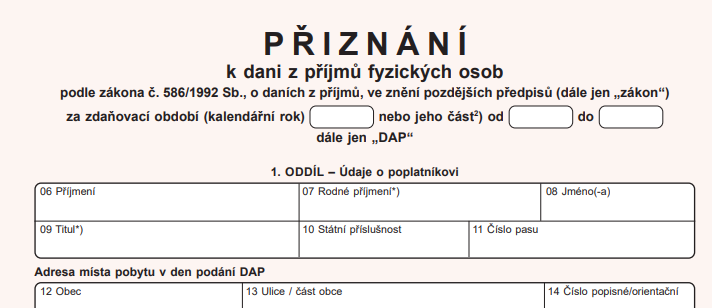

Taxpayers are responsible for:

- Calculating their own tax liability,

- Providing all the required details and supporting information.

The tax return must be submitted:

- Using the official form issued by the Ministry of Finance, or

- Using a software-generated version that exactly matches the official format, or

- Electronically, using remote access, in the structure published by the tax authority (xml).

We are here to help – especially if you’re an expat or freelancer navigating the Czech tax system. Contact us for personalized support.