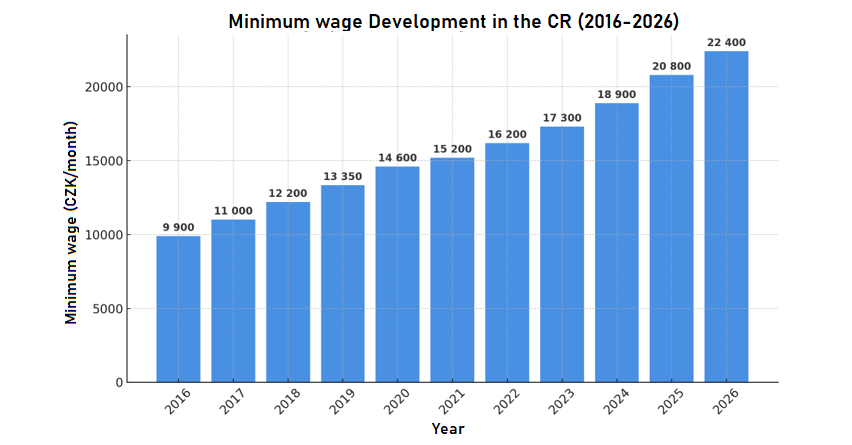

Starting 1 January 2026, the Czech minimum wage will increase by CZK 1,600 to CZK 22,400 per month. This change not only affects employees directly, but it also has important consequences for health insurance contributions, tax benefits, and other thresholds tied to the minimum wage.

In this article, we summarise what you need to know about the new minimum wage, including how it impacts various groups such as employees, pensioners, jobseekers, and parents.

1. Monthly and Hourly Minimum Wage for 2026

Monthly minimum wage: CZK 22,400

Hourly minimum wage (based on a 40-hour work week): CZK 134.40

This increase follows the valorisation mechanism introduced in 2024 into the Czech Labour Code, which links minimum wage increases to the development of the average wage in the economy. The mechanism ensures predictability for employers and employees alike.

The government aims to increase the ratio of the minimum wage to the average wage from approximately 43.4% in 2026 to 47% by 2029.

2. Who Is Directly Affected?

a) Employees

Employers are obligated to pay at least the minimum wage to their full-time employees. This also applies in situations such as:

employees on part-time contracts with wages below the minimum wage,

employees on unpaid leave (with implications for health insurance),

workers under certain contracts who still fall under labour law coverage.

b) Persons Without Taxable Income (OBZP)

For people not actively employed or self-employed, and not classified as “state insured persons,” the minimum health insurance payment equals 13.5% of the minimum wage.

Monthly OBZP insurance payment (2026): CZK 3,024

c) Parents Claiming the Child Tax Bonus

To receive the child tax bonus (a refundable part of the tax benefit), a parent must earn at least 6 times the minimum wage annually in active income (employment or business).

Minimum required income (2026): CZK 134,400

d) Pensioners

State pensions are tax-exempt as long as they do not exceed 36 times the minimum wage annually.

Pension tax exemption limit (2026): CZK 806,400

e) Registered Jobseekers

Individuals registered at the Labour Office can earn up to 50% of the minimum wage per month without losing their registration status.

Maximum monthly earnings (2026): CZK 11,200

However, they must not be on an agreement on performance of work (DPP) and cannot receive unemployment benefits simultaneously.

3. Summary

The increase in the minimum wage impacts much more than just salaries. It serves as a benchmark for various social, health, and tax-related calculations. Understanding these thresholds is essential for proper tax compliance and benefit eligibility.

If you are unsure how this change may affect you or your family, feel free to contact us for tailored advice.

Stay compliant. Stay informed.