The Annual Tax Reconciliation (“ATR”) is a simplified reconciliation of payroll taxes withheld by the employer from the employee’s salary throughout the year. It happens only internally at the employer’s and no documents on behalf of the employee are filed with the tax office.

Who Is Eligible to the ATR?

The ATR for 2019 shall be made by the employer for an employee who:

- Signed a Declaration of the personal income taxpayer with the employer, “Prohlášení poplatníka daně z příjmů fyzických osob ze závislé činnosti” in Czech

- Is not obliged to file a personal income tax return

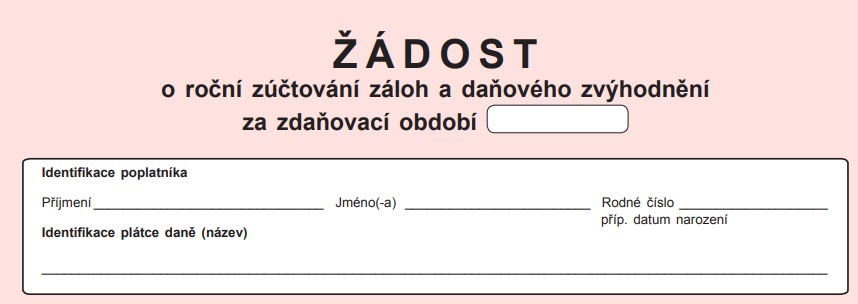

- Applies until 17 February 2020 for the ATR, signs “Žádost o roční zúčtování záloh a daňového zvýhodnění” in Czech

Who Is Obliged to File a Tax Return?

Employees are obliged to file their own personal income tax return especially when:

- Their annual gross employment income exceeded the amount of CZK 1,569,552 (for 2019), which is the limit for solidarity tax increase, or

- They had employment income from multiple employers at the same time (and it was subject to advance tax, not final withholding tax), or

- They had other income higher than CZK 6,000 that is not exempt from tax, e.g. self-employment, rent, capital income or other income

In general everyone whose annual income exceeded CZK 15,000 should file a personal income tax return, but employees having only one employment income where the annual amount was below CZK 1,569,552 can generally apply for the ATR instead of filing a tax return on their own.

What Has To Be Enclosed to the ATR Application?

The employee should submit the following attachments to the application for the ATR:

- Confirmation of taxable income from all previous employers where he/she was employed in 2019, or information on his/her activities until joining his last employer, e.g. proof of registration at the labor office

- Documents proving entitlement to the required tax deductions or tax base deductions