Are you preparing to file your Czech personal income tax return for 2024? Here’s a clear overview of the key deadlines, filing options, and important considerations for taxpayers, including expats, entrepreneurs, and those using a tax advisor.

General Deadline

Under Section 136(1) of the Tax Code, the personal income tax return must be filed no later than three months after the end of the tax period. For the 2024 tax year, the standard filing deadline is 1 April 2025.

This deadline applies whether you file:

- In paper form,

- Electronically, or

- Through a tax advisor (if the advisor files within the standard 3-month deadline).

However, this deadline does not apply to taxpayers who are legally required to have their financial statements audited—these individuals must follow the extended 6-month deadline.

Extended Deadlines

There are two possible extensions for filing:

-

Electronic filing deadline:

If you submit your tax return electronically, the deadline is 2 May 2025 (4 months after the end of the tax year). -

Tax advisor filing deadline:

If a licensed tax advisor or attorney files on your behalf, the deadline is 1 July 2025 (6 months after the end of the tax year). A power of attorney does not have to be submitted to the tax office within the standard 3-month deadline. This is the case since the 2020 tax period.

Important: A tax advisor can still submit the return within the original 3-month deadline (i.e., by 1 April 2025), if preferred. For instance, if the result of the tax return is an overpayment.

Special Case: Taxpayer’s Death

If a taxpayer passes away, the person managing the estate must:

-

Submit a tax return within 3 months of the date of death for the portion of the tax year prior to the death. This deadline cannot be extended.

-

Submit an additional tax return within 30 days after the estate proceedings conclude, covering the period until the day before the conclusion of the estate.

How and Where to File Your Tax Return

Where to File

The personal income tax return must be filed at the locally competent tax office (finanční úřad). For individuals, this is based on their place of residence:

- Czech citizens: address of permanent residence.

- Foreign nationals: address of registered residence.

- If no official residence is registered, the office is determined by where the individual primarily resides in the Czech Republic.

You can look up your local tax office using the Tax Administration Office Locator (in Czech).

Ways to File

You can file your tax return:

- In person at your local tax office,

- By post, or

- Electronically through the Tax Portal (MOJE daně) or through your tax advisor.

Electronic submissions must be sent in the correct format and structure published by the tax authority and signed using a method that ensures verified identity—such as logging into your data box (datová schránka) or using a certified electronic signature.

Mandatory electronic filing:

Taxpayers (or their representatives) must file electronically if they:

- Have an active data box set up by law, or

- Are required by law to have their financial statements audited.

In these cases, paper filings will not be accepted.

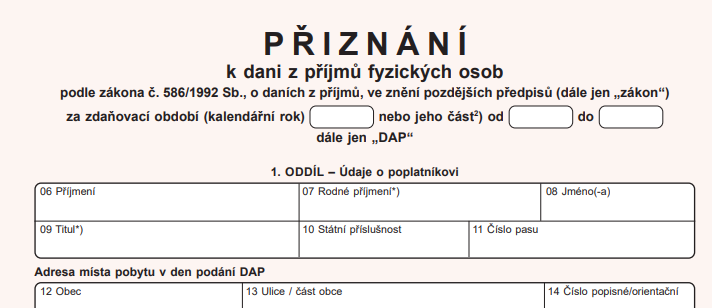

Where to Get the Tax Form

You can obtain the official tax return form:

- At your local tax office,

- From the Financial Administration website, or

- Via the MOJE daně portal, where you can fill out and submit the form online.

Need help filing your return or unsure which deadline applies to you?

We are here to help – especially if you’re an expat or freelancer navigating the Czech tax system. Contact us for personalized support.