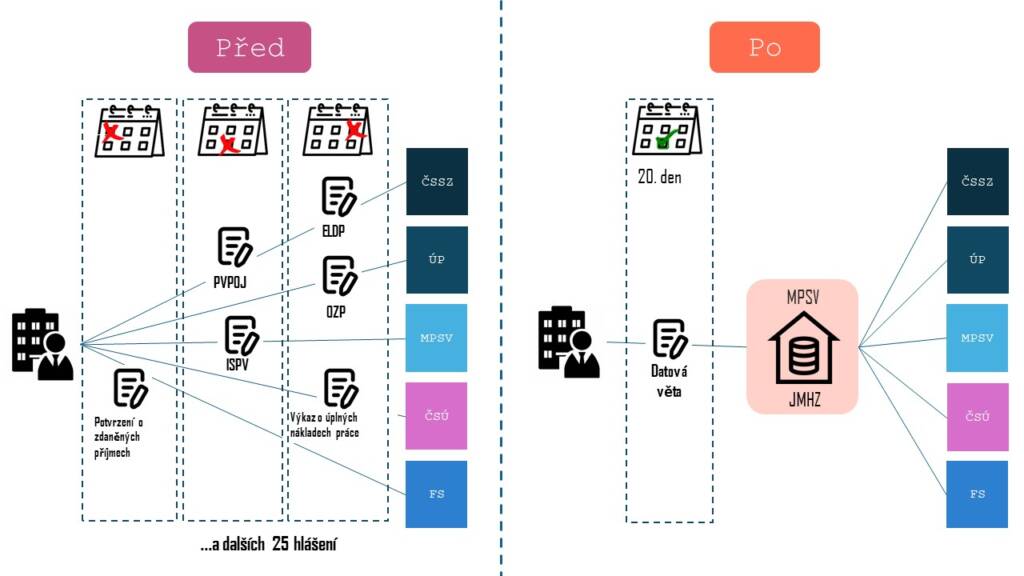

As part of the ongoing digitalization of public administration, the Czech Ministry of Labour and Social Affairs (MPSV) has proposed a new law introducing Unified Monthly Employer Reporting (Jednotné měsíční hlášení zaměstnavatele – JMHZ). In collaboration with the Ministry of Finance, the initiative aims to simplify administrative obligations for employers. Instead of submitting approximately 25 different reports, employers would be required to submit a single monthly JMHZ report to the Czech Social Security Administration (ČSSZ), which would then distribute relevant data to other government agencies. This reform represents a significant shift, as authorities would gain access to individualized employment and payroll data on a monthly basis, rather than the current practice of receiving aggregated employer data.

Key Aspects of the JMHZ Initiative

The JMHZ initiative represents the first stage of a unified tax and social security collection system. Key stakeholders include MPSV, ČSSZ, the Labour Office, the Czech Statistical Office, and the Financial Administration. Each of these institutions has identified specific data requirements essential for their regulatory functions, potentially encompassing up to 400 distinct data points.

The JMHZ report will include:

Employee-specific data, such as income details, tax advances, applied tax reliefs, social security contributions, corrections of tax and insurance payments, and results of annual tax reconciliations.

Employer summary data, including total social security contributions, total tax advances withheld, and the number of employees.

The exact format and structure of JMHZ will be determined by a government decree, with ČSSZ set to publish detailed data specifications. Employers will be required to submit the JMHZ by the 20th of each month for the previous month, with the first submission for January 2026 due by February 20, 2026.

To ensure compliance, employers must submit JMHZ electronically, necessitating substantial adjustments to payroll software. Smaller employers will have access to an online application via the ČSSZ portal. The system will automatically process and distribute data to relevant authorities, eliminating the need for redundant reporting to multiple agencies with varying deadlines.

Exclusions and Additional Considerations

Notably, health insurance companies are not (yet) included in this initiative. Therefore, employer obligations related to health insurance (such as employee registration, reporting changes, and insurance premium summaries) will remain unchanged and separate from JMHZ.

Additionally, the Financial Administration plans to leverage JMHZ data for pre-filling employee tax returns and enabling real-time access to personal tax accounts via the Moje Daně (My Taxes) portal.

Employer and Employee Registration, Compliance, and Penalties

To facilitate JMHZ, employers must be registered with ČSSZ as official employers. They will also be required to register all employees, including those in non-insured work arrangements, in a newly established Employee Registry.

Upon registration, employees will receive a unique and permanent social security number, valid across different employment relationships. Additionally, each employment arrangement will receive a distinct job identifier.

Non-compliance with JMHZ reporting obligations will result in significant penalties, which will be enforced by ČSSZ.

Proposed Abolition of Withholding Tax on Employment Income

The JMHZ initiative also includes proposed amendments to related laws. Some changes naturally follow from JMHZ implementation, such as eliminating various notifications and reports, introducing new registries, removing employer tax registration requirements, and adjusting the deadline for annual tax reconciliation requests.

A major proposed amendment to the Income Tax Act involves the abolition of the 15% withholding tax on certain employment income. Currently, this tax applies in cases where an employee does not submit a taxpayer declaration for:

Low-income employment (earnings below CZK 4,500 per month)

Agreements on work performance (DPP) with earnings below CZK 11,500 per month

Income received by non-resident board members and corporate executives

Under the new proposal:

Withholding tax on DPP and low-income employment would be abolished from January 1, 2027. This could significantly increase the number of employees required to file tax returns, as small supplementary incomes would be taxed via advance payments instead.

Withholding tax on non-resident board members and executives would be abolished as of January 1, 2026. This would subject such income to progressive taxation (15% up to 36 times the average salary, 23% above this threshold).

Forms to Be Replaced by JMHZ

The introduction of JMHZ is expected to replace several existing forms, including:

DPP Reporting Form (introduced July 1, 2024)

Notification of Employment Commencement (ČSSZ)

Social Security Insurance Contribution Overview (including employer discounts)

Pension Insurance Record Sheet

Confirmation of Taxable Employment Income

Payroll Tax Withholding Statement

Withholding Tax Statement on Income Subject to Special Tax Rate

Mandatory Quota Reporting for Disabled Employees

Employment Notifications for EU/EFTA Nationals and Certain Non-EU Foreigners

Legislative Process and Future Updates

The JMHZ legislative proposal is still in its early stages and currently undergoing stakeholder consultations. Changes to the draft law are expected before final approval. We will continue to monitor and provide updates on its development.